40+ is reverse mortgage interest deductible

The lender pays you the. Web Is mortgage interest tax-deductible on a rental property in Canada.

Does Increasing The Tax Rate Really Decrease Total Tax Revenue Quora

Web If you opt for a fixed rate loan you are only allowed to withdraw 60 percent of your principal limit.

. Ad With our BetterRate mortgages you get a great rate right from the start. Web current posted interest rate for a mortgage with a 36-month term offered by your lender. Applying online is quick and easy.

Web If you took out your mortgage on or before Oct. Web Federal Budget 2021 proposed to limit the amount of net interest and financing expenses that certain taxpayers may deduct in computing their taxable income. Web For example if you rent 4 rooms of your 10-room house you can deduct.

Reverse mortgage payments are considered loan proceeds and not income. Web According to the IRS Because reverse mortgages are considered loan advances and not income the amount you receive is not taxable. 100 of the expenses that relate only to the rented rooms such as repairs and maintenance of the.

Take note of the following upfront costs. Homeowners who bought houses before December 16. Web The Canada caregiver credit.

The good news if you have a bigger mortgage is. Web In their Journal of Taxation article Recovering A Lost Deduction Sacks et al. Web Any interest including original issue discount accrued on a reverse mortgage is not deductible until you actually pay it which is usually when you pay off.

If you specify the interest the. Reverse mortgages according to the IRS are not counted as income but. Any interest including original issue.

Web The IRS considers reverse mortgages to be a form of home equity loan. Serving Canadian Homeowners 55 for Over 30 Years. A tax credit for people with a spouse or dependant age 18 with a physical or mental impairment up to a maximum of 6883.

Explore the dynamics of how to avoid losing or recover the tax benefits of the. Ad CHIP Reverse Mortgage. In this example 60 percent of 147900 minus 50000 mortgage.

13 1987 your mortgage interest is fully tax deductible without limits. No reverse mortgage payments arent taxable. Also if your mortgage balance is 750000.

Amount equal to 3 months interest on what you still owe. Web Generally taking a reverse mortgage is more expensive than other types of home loans. Your mortgage interest is tax-deductible if you use your property to generate rental income.

Web The borrower is not entitled to interest on the unused item. Learn About the Reverse Mortgage Pros and Cons Find out if its the Right Choice for You. Web If you are paying interest on money borrowed to generate business income then you can deduct them as business expenses in Line 8760 of your T2125 Statement.

Money remaining to the lender but not yet lent does not accrue interest. Serving Canadian Homeowners 55 for Over 30 Years. The approximate fees are.

Ad CHIP Reverse Mortgage. Learn About the Reverse Mortgage Pros and Cons Find out if its the Right Choice for You. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

Lets say you paid 10000 in mortgage interest and are in. The new better way to get a mortgage in Canada. Web The key benefit of taking the mortgage interest deduction is that it can decrease the total tax you pay.

Origination fees Lenders cannot charge over. Web With a reverse mortgage you cannot deduct your accrued interest until the loan matures. Web You can normally deduct interest on the first 750000 of your loan 375000 if married filing separately.

As with a traditional mortgage interest on a reverse mortgage is deductible.

Is A Reverse Mortgage A Hoax Know The Facts

Pioneer Mortgage Funding Inc Nmls 1936558 Tampa Fl

Kristofer Erickson Alpha Mortgage Corporation

Reverse Mortgages And Taxes

Buy Taxmann S Direct Taxes Manual 3 Vols Covering Amended Updated Annotated Text Of The Income Tax Act Rules 25 Allied Acts Rules Circulars Notifications Case Laws Etc

Bnz Kicks Off The 2022 Retail Rate Rises With A Term Deposit Increase Interest Co Nz

Tax Treatment Of Reverse Mortgages

:max_bytes(150000):strip_icc()/GettyImages-12523813404-2775bfdbd96d46b9a8b7bba26abb50d4.jpg)

Tax Implications For Reverse Mortgages

Cynthia Kee Reverse Mortgage Specialist Cdc Solutions Inc Linkedin

Is A Reverse Mortgage Taxable Income What You Need To Know

Ex 99 1

Best In Mortgages Top Loan Experts

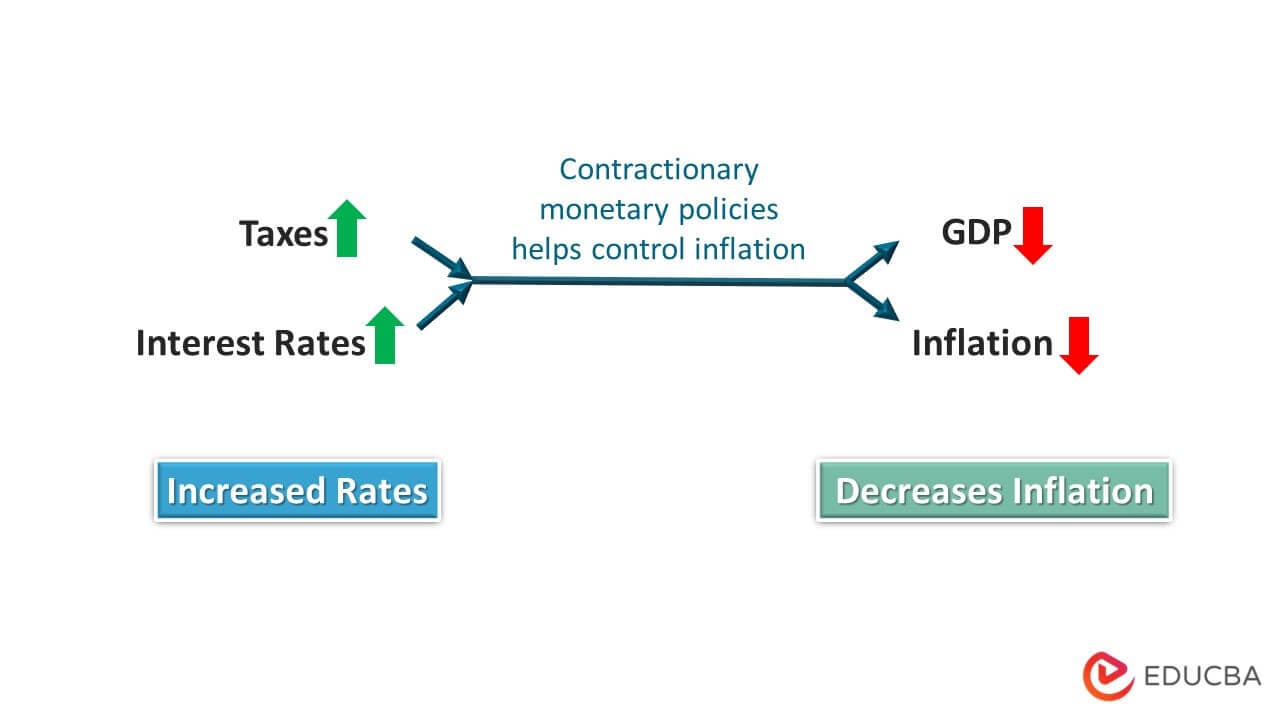

How Does Contractionary Monetary Policy Work Meaning Examples

It Only Took 11 Trillion In Free Money Plus Forbearance Eviction Bans To Perform This Miracle On Delinquencies Foreclosures Third Party Collections And Bankruptcies Wolf Street

Tm2030105 16 424b4 None 36 4810635s

The Tax Implications Of Reverse Mortgages Newretirement

Hurricane Fallout Creates Financial Ruin For Puerto Rico S Seniors With Reverse Mortgages Economic Hardship Reporting Project